Older Person's Shared Ownership (OPSO)

As we get older, we start thinking about where we want to live. One option that's becoming more popular is Older Person's Shared Ownership (OPSO).

This scheme, supported by the government, helps retired people become homeowners without paying for 100% of the property.

OPSO is more than just owning a home

It's about creating a friendly community where older people can support each other and enjoy life together.

This scheme is part of the government's efforts to solve housing problems for the ageing population.

In simple terms, OPSO gives you a chance to have a comfortable and sustainable home in your later years.

How OPSO works on retirement living homes

You can buy part of the property and rent the rest, which reduces your financial burden while still giving you the benefits of being a homeowner at a retirement living community you love.

Older individuals have the opportunity to purchase a share of their home, typically between 25% and 75%.

They then pay rent on the remaining portion that they don't own.

It is often referred to as a 'part buy/part rent' scheme because it combines elements of buying and renting, however, it’s worth noting that retirement builders can offer their own part buy, part rent (PBPR) schemes that are unrelated to OPSO.

For example, retirement housebuilder McCarthy Stone offered PBPR before the Government released OPSO.

How is OPSO different from general shared ownership?

While OPSO shares similarities with general shared ownership schemes, there are key differences:

Targeted towards older adults: OPSO is specifically designed for older individuals who are looking for a comfortable living environment in their later years.

Focus on retirement communities: Unlike traditional shared ownership properties, OPSO homes are located within retirement communities.

Additional benefits: These retirement communities often offer extra perks such as access to care services and community facilities, making them more suitable for retirees.

Specially designed properties: Each retirement living flat in these communities is created with the specific needs of older adults in mind, providing features like accessibility, safety measures, and spaces for socialising.

Benefits and advantages of OPSO for older homebuyers

Here are some key advantages:

1. Increased affordability

Instead of buying an entire property, you only purchase a share that you can afford - usually between 25% and 75%. This reduces both the initial deposit and mortgage payments.

2. Reduced maintenance responsibilities

In OPSO properties, the designated staff in your retirement community take care of many maintenance tasks such as gardening, window cleaning and cleaning of shared areas. This is unlike traditional homeownership where you might have to handle everything yourself.

3. Access to tailored care services and amenities

Living in OPSO developments gives you access to specific care services and amenities designed for older individuals like yourself. These developments often have communal areas such as gardens and lounges where you can socialise with other residents. Not having to leave your home for these social interactions can greatly improve your quality of life.

4. Extra support with OPSO schemes offering extra care facilities

For those who need extra support, certain OPSO schemes provide extra care facilities that offer a range of services from personal care to assistance with daily activities. Having these resources available on-site ensures that you can receive the necessary care while still maintaining your independence.

These various benefits make OPSO an excellent choice for older individuals seeking affordable, supportive homeownership in their later years.

What’s the eligibility criteria for the Older Persons Shared Ownership scheme?

If you choose to apply for the Older Persons Shared Ownership to part buy and part rent a retirement flat, the general eligibility criteria is:

- You must be aged 55 years or older. However, some OPSO developments will allow a couple where the main applicant is 55 but a second applicant is 50 or older.

- Your maximum household income must not exceed £90,000 per annum in London or £80,000 outside of London.

- You are a first-time buyer, you used to own a home but can’t afford to buy one now or are an existing shared owner looking to move.

How to get started with Older Person's Shared Ownership (OPSO) in 4 easy steps

Step 1: Research Retirement Operators

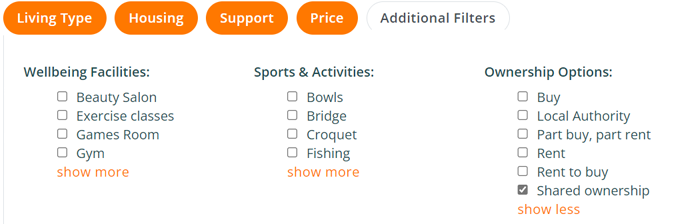

Search for retirement living villages and communities in your local area using Autumna.

Autumna lists hundreds of retirement living communities in the UK including those that offer shared ownership scheme properties such as:

- Anchor

- Housing 21

- McCarthy Stone

- MHA Retirement Living

- Orbit

- Pegasus

- Retirement Villages

- Richmond Villages

Consider factors like location, available amenities, facilities and community atmosphere while making your decision.

Step 2: Check the availability of OPSO properties with the provider

Some retirement home providers may only have a limited number of apartments available to buy under the Older Person’s Shared Ownership scheme.

Step 3: Plan how to manage ongoing costs effectively

Talking to a financial advisor with experience in retirement living and older person’s shared ownership can be an effective way to create a realistic budget and calculate the most cost-efficient retirement housing route for you.

Step 4: Apply for OPSO

Once you've found a suitable property, gather the necessary documents for application submission.

This includes proof of age, income statements, and an outline of your housing needs. Remember, a detailed and well-presented application increases your chances of approval.

An OPSO property could be your gateway to a fulfilling and independent life

Older Person's Shared Ownership (OPSO) presents a unique opportunity for affordable and supportive homeownership in retirement.

For those who want financial flexibility without giving up the comfort and community of retirement living, OPSO could be perfect.

Talk to an elder care expert at Autumna for more information about retirement living or search for operators in your area and filter for ‘Shared Ownership’.

Expert Advisers

Our team of expert advisers are on hand to offer FREE advice. Get in touch with Autumna and our advice partners by following the links below.

Care Funding

Care Advice Line

Equity Release Advice

Contact Us

Free Provider Shortlist

Share this article if you found it helpful:-)