Posted by Janine Griffiths

Guide to adult social care funding

The demand for adult social care funding has been on the rise for several years as the cost-of-living increases, along with the widening gaps in financial support and assistance.

With life expectancy rising, the ageing population continues to grow, leaving more people struggling to afford care.

According to the King’s Fund, there were more than two million requests for adult social care funding in 2022/23 with the number of requests rising steadily since 2015/16.

Our research shows that care home fees vary significantly across the UK, with some exceeding £57,000 per year, depending on the provider and location. However, according to the government, one in seven adults aged 65 and over face lifetime care costs of more than £100,000.

As a result, the growth in care costs has resulted in many senior people being unable to access the care they need, with fewer than half of people receiving support, according to the Nuffield Trust. Therefore, with costs rising and many people struggling to keep up with the expenses associated with care, it's no surprise that many people worry about how they will afford it.

The good news is that there is some help available for those that are struggling, in addition to options that self funders can use to pay for their own care. We will go through all of these in this blog, as we explore the complexities of adult social care funding.

Who is responsible for adult social care funding?

In the UK, adult social care funding is managed by local authorities. This means that local councils are responsible for deciding how much they will pay towards social care in their location. Unlike NHS funding, local authority funding is not free at the point of service and only those with assets below £23,250 will be eligible to apply in England and Northern Ireland. To find out whether you are eligible, you will need to contact your local authority and take a means test.

Funding options for self-funders

When funding care independently, it’s important to explore all available financial options to ensure long-term affordability. Here are some of the main ways self-funders can cover care home costs:

Personal savings & assets

Many people use their savings, pensions, or investments to pay for care. While this can offer flexibility and immediate access to a preferred care home, it’s essential to plan ahead to ensure funds last. Speaking to a financial adviser can help manage assets efficiently and explore tax-efficient strategies for funding care.

Equity release

For homeowners, equity release allows access to the value tied up in their property without the need to sell immediately. There are two main types:

- Lifetime mortgages – a loan secured against the home that is repaid when the property is sold.

- Home reversion plans – selling part or all of a home in exchange for a lump sum or regular payments. Equity release can be a useful way to cover care costs, but it’s important to seek specialist advice, as it can impact inheritance and eligibility for certain benefits.

Deferred payment agreements

A deferred payment agreement (DPA) is an option for those who own a home but prefer not to sell it immediately. Offered by local authorities, this scheme allows individuals to delay paying care home fees by borrowing against the value of their property. The loan is repaid when the property is eventually sold or from the estate after passing away. Eligibility criteria apply, and interest may be charged, so it’s important to check with the local council for details.

Care fee annuities

A care fee annuity, also known as an Immediate Needs Annuity, is a financial product designed to cover care costs for life in exchange for a one-time lump sum payment. The amount paid depends on factors such as age, health, and expected care needs. While this option provides financial security and peace of mind, it requires upfront investment, so professional advice is recommended to determine whether it is the right choice.

By understanding these funding options, self-funders can make informed decisions about how to cover care costs while protecting their financial stability. Seeking independent financial advice can help ensure the most suitable approach based on personal circumstances.

Even if you are self-funding your care, there are financial support options that may help cover some costs. Understanding what is available can ensure you don’t miss out on valuable assistance.

For more information on funding your own care check out our ‘Ultimate guide to self-funding care.’

Local authority support – who qualifies and how to apply

Local authorities provide means-tested financial support for care home fees, depending on a person’s income and assets. If your capital falls below the upper threshold (£23,250 in England), you may be eligible for assistance. The key steps include:

- Care needs assessment – conducted by the local authority to determine the level of care required.

- Financial assessment – examines savings, income, and property to assess eligibility for funding.

- Personal budget allocation – if eligible, the council calculates the contribution towards care costs.

Even if you exceed the financial threshold, you can still request a care needs assessment, which may help access other types of non-financial support.

NHS funding

For those with significant ongoing health needs, the NHS offers funding that may cover some or all care home costs:

- NHS Continuing Healthcare (CHC) – NHS CHC funding fully covers care home fees for individuals with complex, long-term medical conditions. Eligibility is based on a detailed assessment of care needs rather than financial circumstances.

- NHS Funded Nursing Care (FNC) – Provides a weekly contribution (£219.71 per week in England for 2023/24) towards nursing care for those in a care home with registered nursing staff. This is available to those who do not qualify for full CHC funding but still require nursing support.

Assessments for both types of NHS funding are conducted by local Integrated Care Boards (ICBs). It’s worth exploring these options if nursing or specialist medical care is required.

Benefits

Additionally, self-funders may be eligible for certain state benefits, such as:

- Attendance Allowance – a non-means-tested benefit for those over 65 who need help due to illness or disability (£68.10 or £101.75 per week).

- Personal Independence Payment (PIP) – available to those under 65 with long-term health conditions.

- Council tax reduction – some exemptions apply for individuals receiving care.

Exploring these options can help ease financial pressures, even for those funding their own care. Seeking professional advice can also ensure that all available support is accessed.

Care home fees can be a significant financial commitment, so planning ahead is essential to ensure long-term affordability and avoid unnecessary financial strain. Taking proactive steps can help you make informed decisions and protect your assets while securing the best possible care.

Why early financial planning is crucial

Many people only consider care funding when the need arises, but planning ahead can offer greater financial security and peace of mind. Early preparation allows you to:

- Explore all funding options and make informed decisions.

- Maximise eligibility for financial support, such as local authority assistance or NHS funding.

- Avoid having to make rushed decisions in a crisis.

- Ensure your assets, including your home and savings, are managed efficiently to sustain care costs.

Seeking professional advice

Navigating the complexities of care funding can be overwhelming, so seeking guidance from financial and legal professionals is highly recommended. Experts who can help include:

- Independent Financial Advisers (IFAs) – specialists in later-life financial planning can help structure your finances to cover care costs effectively, including investment strategies and insurance options.

- Solicitors – legal professionals can assist with wills, trusts, and lasting power of attorney (LPA) to ensure your finances and care preferences are managed according to your wishes.

- Society of Later Life Advisers (SOLLA) – accredited advisers who specialise in financial planning for older adults and care funding.

Free resources

If you are looking for free advice and information on adult social care funding, Autumna can help. Our friendly and knowledgeable advice team can help with any questions you have about funding later life care or direct you to resources that can help. You can contact them on 01892 335 330.

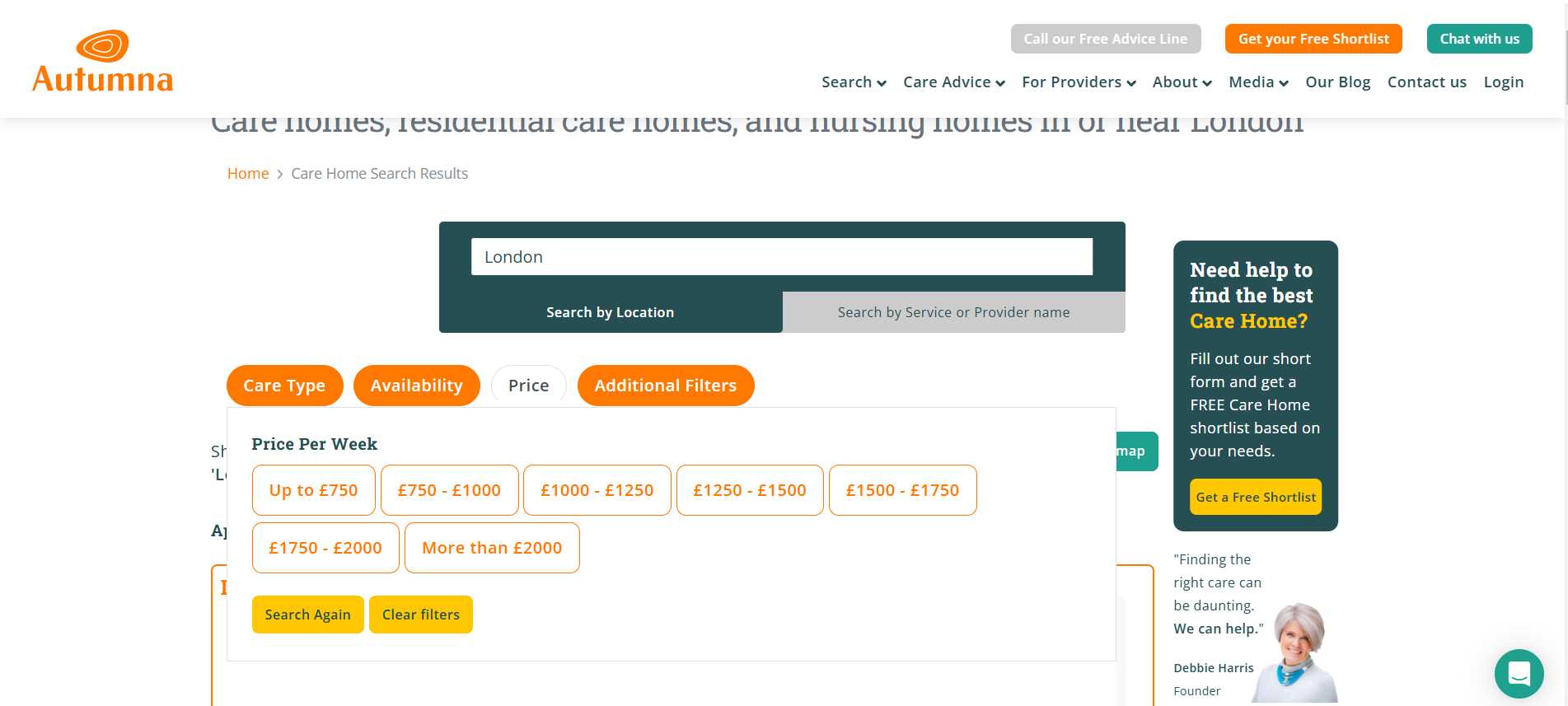

We also have a resource to help you find care homes that are within your budget. All you have to do is head over to our homepage, and type in your location. This will then bring up a list of results. You can filter the results by price to select care homes within your budget.

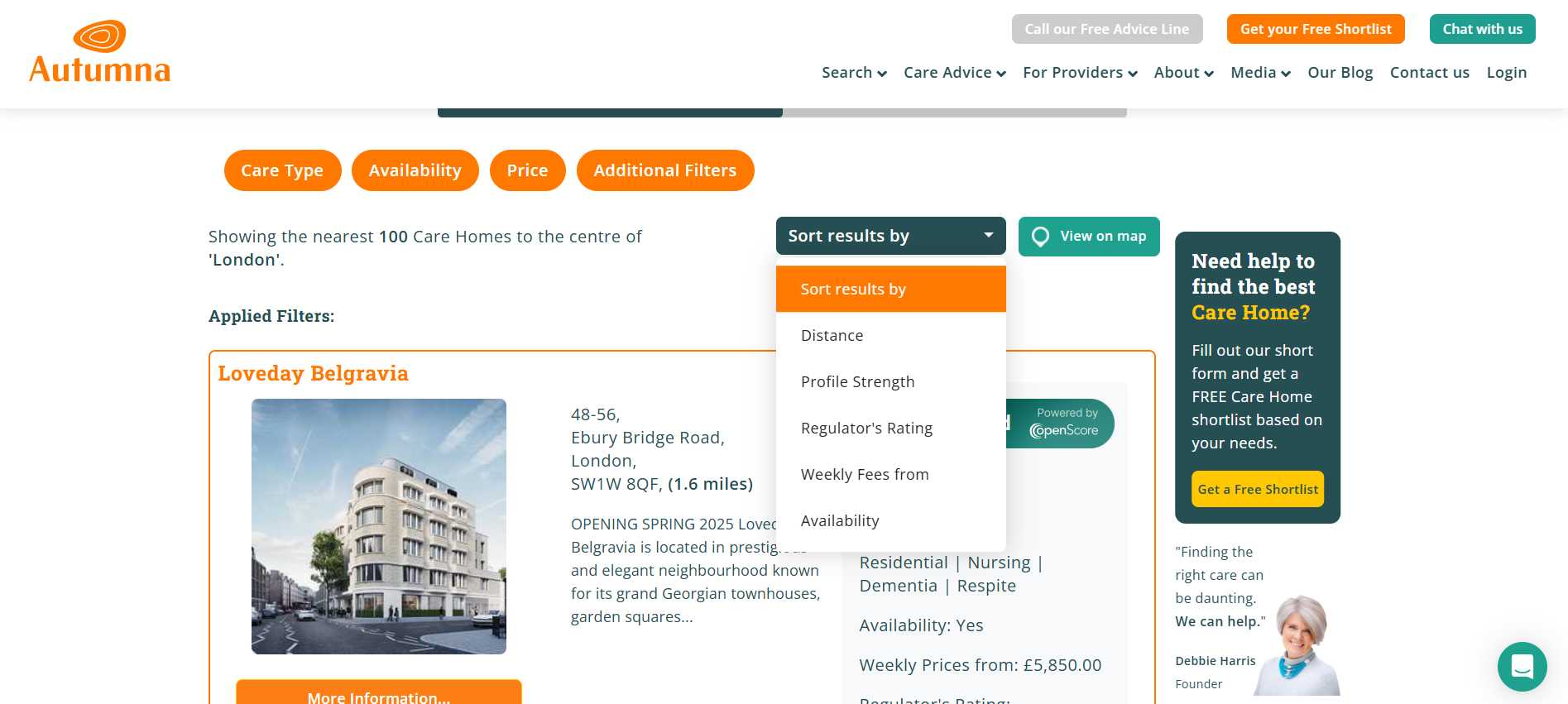

You can also sort results by weekly fees - from lowest to the highest.

Following the above steps can help you find affordable care homes.

Alternatively, you can use our shortlisting tool and answer a few quick questions and our system will generate a list of affordable care providers in your area.

Avoiding common pitfalls in care funding

Without proper planning, families can face financial difficulties when funding long-term care. Some key mistakes to avoid include:

- Delaying financial planning – waiting until care is urgently needed can limit funding options.

- Giving away assets without professional advice – transferring property or savings to family members may have tax implications or affect eligibility for local authority funding.

- Overlooking benefits and entitlements – many people miss out on financial support, such as Attendance Allowance or NHS funded nursing care.

- Failing to consider long-term affordability – costs can rise over time, so it’s crucial to plan for increasing care fees.

By taking a proactive approach and seeking expert advice, you can ensure that your finances are well-structured, giving you confidence that the right care will be accessible when needed.

Receive a Free Care Provider Shortlist!

Let our expert team of advisers get your search off to a great start.

Tell us a little about your needs and we'll send you a bespoke shortlist of care providers! Click the button below to begin, it takes just a few minutes.

Other articles to read

From the blog

Older Persons Care Advice

Ultimate guide to care homes in Norwich

April 23rd, 2025

Discover the best care homes in Norwich—explore lifestyle-focused options, top-rated services, and how to choose the right home with confidence.

Older Persons Care Advice

How to find an adult day care centre near you

April 22nd, 2025

Looking for an adult day care centre near you? Discover how to find safe, joyful care for your loved one—and support for yourself—on Autumna.

Older Persons Care Advice

How to shortlist care homes in Exeter

April 17th, 2025

Need help shortlisting care homes in Exeter? Learn how to filter options with confidence, compare homes, and find the best fit with Autumna’s free tools.

Frequently Asked Questions

Adult social care funding is means-tested in the UK, meaning eligibility depends on your savings, income, and assets. Those with assets below £23,250 (England) may qualify for local authority support. A care needs and financial assessment will determine the level of funding available.

Self-funders can explore options like personal savings, equity release, deferred payment schemes, and care fee annuities to cover care costs. Seeking financial advice can help determine the most suitable approach for long-term affordability.

Use Autumna’s search tool to find care homes within your budget by filtering results by price. You can also use our shortlisting tool to get personalised recommendations based on your needs.