Posted by Janine Griffiths

How to manage live in care costs

As the population ages, more families are considering live-in care as a viable option for supporting their loved ones. Live-in care offers a unique blend of personalised care and the comfort of staying in one’s own home, making it an increasingly popular choice for those needing daily assistance.

However, the cost of live-in care can vary widely, and understanding these costs is crucial for making informed decisions.

In this guide, we’ll break down the factors that influence live-in care costs, explore the various funding options available, and provide practical tips for budgeting effectively.

Whether you’re planning for yourself or a loved one, this guide aims to equip you with the knowledge needed to navigate the financial aspects of live-in care with confidence.

What is live-in care?

Live-in care is a type of care service where a professional caregiver resides in the home of the person needing assistance, providing round-the-clock support.

Unlike traditional residential care homes or nursing homes, live-in care allows individuals to receive personalised care while remaining in the comfort and familiarity of their own home.

The caregiver assists with a variety of daily activities, including personal care (such as bathing, dressing, and grooming), meal preparation, medication management, and mobility support.

In addition to these essential services, live-in carers also offer companionship, helping to alleviate feelings of loneliness and providing emotional support.

What impacts live-in care costs?

The cost of live-in care is affected by a number of factors, such as the amount of care you need, where you live, care provider fees and additional care costs. We discuss all of this in further detail below:

Level of care needed

The cost of live-in care is heavily influenced by the level of care required. Basic care typically includes assistance with daily activities such as bathing, dressing, meal preparation, and light housekeeping. This type of care is suitable for individuals who are relatively independent but need some help with routine tasks.

On the other hand, complex care involves more intensive support, such as managing chronic health conditions, providing mobility assistance, or administering medication. Complex care may also include specialised services like dementia care, post-operative care, or palliative care. As the complexity and intensity of the care increase, so does the cost, as it often requires caregivers with advanced training and experience.

24/7 care and specialised services

Live-in care generally means that the caregiver is available 24/7, providing peace of mind that help is always on hand. However, this level of availability can also raise costs, especially if the individual requires specialised services that go beyond typical caregiving duties.

For instance, specialised care might involve handling medical equipment, offering rehabilitation exercises, or providing consistent care throughout the night.

The need for continuous monitoring or intervention further drives up costs, as it may necessitate a team of caregivers to ensure that care is not interrupted.

Quantity of care

The cost of care is also influenced by how many days you need a carer for. If you require a live-in carer to be with you every day of the week, the costs will be considerably higher compared to having a carer for just one or two days. However, if you have a family member who can assist on most days, or you only need occasional help with basic household tasks, this can be a more cost-effective option.

Other costs to consider with live-in care

In addition to the costs of a live-in carer, there are other costs you may want to consider when trying to budget for this type of care. These are:

Food: It is important to factor in the cost of food shopping and groceries, because a live-in carer will most likely be sharing food with yourself or your loved one. If they have special dietary or nutritional needs then this may also add to the expense, so be sure to factor this in when calculating the cost.

Petrol: Depending on the exact nature of the role, a live-in carer may need to drive the patient to appointments, events, or run social errands. So, consider the fuel costs, fees and maintenance. There may also be insurance premiums that need to be paid if the carer uses their own vehicle.

Special Occasions: If there are special occasions, events or gatherings that a carer will be transporting you or your loved one to, this may incur additional fees. This could include tickets to events, travel expenses, or extra charges for such a service.

All of these factors can add significantly to the costs of live-in care and it is best to discuss this upfront to avoid any surprises or misunderstandings.

To find out more about live-in costs, check out our blog, ‘How much is live-in care in 2024.’

Funding Options for Live-in Care

When it comes to funding live-in care, understanding the various options available is crucial for making informed decisions. Below are some of the key funding sources that individuals and families can explore.

Self-Funding

For many, self-funding is the primary method of covering live-in care costs. This approach involves using personal savings, investments, or the value of assets such as property to pay for care services.

Self-funding allows for greater flexibility in choosing the type and level of care, as well as selecting a preferred care provider.

However, it’s important to consider the long-term sustainability of this option, especially if care is needed over an extended period.

Careful financial planning is essential to ensure that funds are managed effectively to cover ongoing healthcare needs.

For more tips on funding your own care, check out our blog, ‘Ultimate guide to self funding care.’

Local Authority Funding

Local authority funding may be available to help cover the cost of live-in care, but eligibility is subject to strict criteria.

Typically, individuals must undergo a needs assessment conducted by the local authority to determine the level of care required.

Following this, a financial assessment or means test is carried out to evaluate the individual's income, savings, and assets.

Your local council may contribute to the cost of your care if you have less than £23,250 in savings (called the upper capital limit, or UCL).

However, it is worth noting that this funding might only cover a portion of the costs, and individuals may still need to contribute towards their care.

To learn more about local authority funding, the NHS website provides more information.

NHS Continuing Healthcare Funding

NHS Continuing Healthcare (CHC) funding is a package of care fully funded by the NHS for individuals with significant ongoing healthcare needs.

To qualify, an individual must undergo a comprehensive assessment by a team of professionals who evaluate the nature, complexity, intensity, and unpredictability of their needs. Learn more about NHS help with funding care.

Insurance and Annuities

Another option for funding live-in care is through long-term care insurance or by purchasing an annuity.

Long-term care insurance is designed to cover care costs, including live-in care, for those who require assistance with daily activities. Policies vary, so it’s important to review the terms carefully to understand what is covered and any limitations that may apply.

An annuity is a financial product that provides a regular income in exchange for a lump sum payment. Some annuities are specifically designed to cover care costs, providing a guaranteed income to help pay for a live-in carer over time.

This option can provide financial security, ensuring that care costs are covered for the duration of the individual’s life. As with any financial product, it’s advisable to seek professional advice to determine the most suitable option based on individual circumstances.

How to budget for live-in care costs

In order to get the right care for yourself or your loved one, it is important to budget for the cost of your care provision.

Knowing in advance how much care you are likely to need, and how you will plan for the long term can provide you with a sense of reassurance and help you make an informed decision about the cost of your care.

Below, we discuss some of the main ways you can plan ahead for your live-in care costs.

Estimating live-in care costs

The first step you need to take is to calculate how much your live-in care costs are likely to be. The total cost will depend on several factors, including the level of care required, the frequency and duration of care, and the geographical location.

To calculate potential costs, start by assessing the specific care needs of the individual—this includes considering whether they need basic assistance with daily tasks or more complex medical care.

Next, research the typical rates for live-in care in your area, keeping in mind that prices can vary significantly across different regions. It’s also important to factor in any additional costs that might arise, such as travel expenses for the carer or the need for specialised equipment. By considering all these elements, you can develop a clearer picture of the overall cost and ensure that you are prepared for any financial commitments.

Financial Planning Tips

Next you will need to identify all sources of income and savings, as well as any potential funding options available, such as local authority funding or NHS Continuing Healthcare.

Be sure to list all anticipated expenses, including the cost of care, household bills, and any other ongoing financial obligations. It’s also wise to set aside a contingency fund to cover unexpected costs that may arise, such as additional medical expenses or emergency care. Regularly review and adjust the budget as care needs change over time, ensuring that it remains sustainable in the long run.

Seeking Professional Advice

Given the complexity of funding long-term care, consulting with a financial advisor who specialises in elder care can be incredibly beneficial.

A professional advisor can provide personalised guidance on the best ways to manage your finances, including advice on how to maximise savings, explore funding options, and ensure that your money lasts as long as it’s needed.

By seeking expert advice, you can make informed decisions that provide financial security and peace of mind for the future.

For advice on live-in care costs and any other aspect of later life care, consider getting in touch with the Society of Later Life Advisors (SOLLA).

How to reduce the cost of live in care

Live-in care costs can be quite substantial. While there is plenty of financial help available, there are a few ways to further reduce the expense:

Negotiating with care providers

Start by obtaining quotes from multiple care providers to get a clear understanding of the market rates and what each provider offers. When discussing costs, be transparent about your budget and care needs, and ask if there are any flexible options or discounts available.

Being open and communicative with care providers can help you find a solution that fits both your care requirements and your financial situation.

Exploring shared care options

Shared care is an alternative arrangement that can significantly reduce the cost of live-in care. In a shared care scenario, two individuals or families share the services of one carer. This arrangement can be particularly effective if both individuals require care but not on a full-time basis.

For instance, the carer may split their time between two homes, providing assistance in the mornings at one location and evenings at another. This setup allows both parties to benefit from professional care at a fraction of the cost of hiring a full-time live-in carer individually.

However, it’s essential to ensure that the carer’s time and attention are adequately divided and that both parties' needs are met. Discussing and agreeing on a clear schedule and responsibilities with both the carer and the other party involved is crucial for making shared care work smoothly.

Using assistive technology

Assistive technology can play a significant role in reducing the need for full-time live-in care, thereby lowering costs. Various devices and systems are available to help individuals maintain their independence and manage daily tasks with minimal assistance. For example, telecare systems can monitor a person’s safety and well-being, alerting caregivers or family members in case of emergencies, such as falls or health crises.

Additionally, mobility aids, such as stairlifts or electric wheelchairs, can help individuals move around their home more easily without requiring physical assistance from a carer.

By integrating these technologies into the care plan, it’s possible to reduce the number of hours a live-in carer is needed, making care more affordable while still ensuring the individual’s safety and comfort.

How to choose the best live-in care

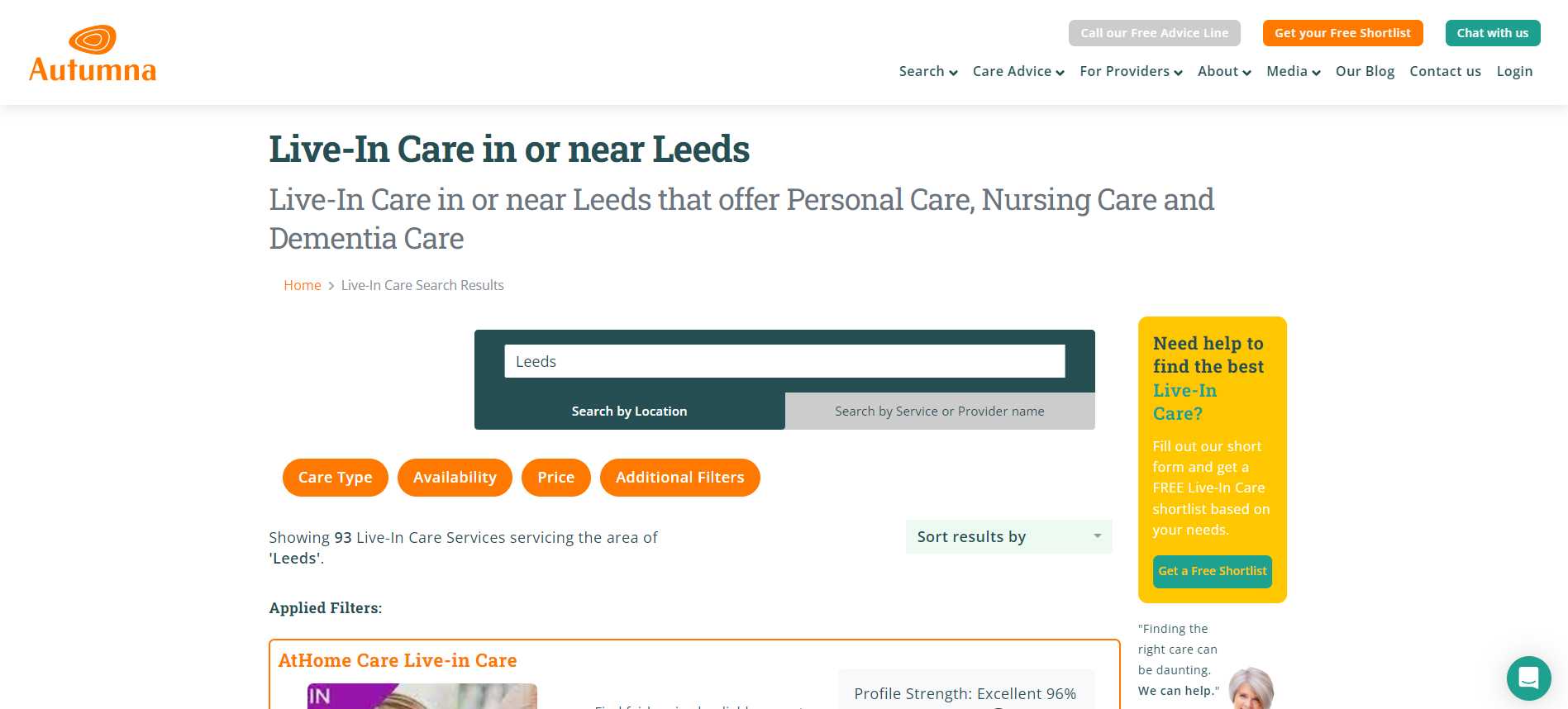

With Autumna, this process couldn’t be easier. All you have to do is navigate to our homepage, and select live in care. Then, simply type in your area, and it will bring up a list of live-in care providers.

Alternatively, you can also use our FREE Shortlisting Tool, and answer the questions when prompted. After that, the system will generate some live-in care providers based upon your answers. You can also give us a call on 01892 335 330 and speak to one of our friendly care experts.

Receive a Free Live-In Care Shortlist!

Let our expert team of advisers get your search off to a great start.

Tell us a little about your needs and we'll send you a bespoke shortlist of live-in care providers! Click the button below to begin, it takes just a few minutes.

Other articles to read

From the blog

Older Persons Care Advice

How to shortlist care homes in Exeter

April 17th, 2025

Looking for an adult day care centre near you? Discover how to find safe, joyful care for your loved one—and support for yourself—on Autumna.

Older Persons Care Advice

What is Discharge to Assess?

April 16th, 2025

Discover how Discharge to Assess (D2A) supports faster recovery, reduces hospital stays, and how Autumna helps simplify finding the right care.

Older Persons Care Advice

What are the benefits of person-centred care?

April 9th, 2025

Discover the benefits of person-centred care—from improved wellbeing to better outcomes—for individuals, families, and care providers alike.

Frequently Asked Questions

A live-in carer is a professional that comes to live with you in your home for a specified period of time. Their duties may include helping with personal care, household chores, meal preparation, medication management, companionship, and running errands, all tailored to your specific needs.

Live-in care involves a caregiver residing in the client's home and providing 24/7 support, while home care typically involves a caregiver visiting the client at scheduled times for specific tasks.

Depending on your needs, live-in care costs can sometimes be lower than that of a care home, especially when considering the personalised attention and ability to stay in one's own home. However, this also depends on the fees charged by your care provider, cost of care homes in your area and location. These are just some of the factors that can impact live in care costs vs the cost of a care home.

Autumna can help you choose the right live in care provider. Simply head over to our homepage, select live-in care, and type in your preferred area. This will bring up a list of care providers that are available in your area.