Posted by Janine Griffiths

The impact of pension credit news on elderly care

Navigating the financial aspects of elderly care can be daunting for families, especially when considering the rising costs of care homes. For many, pension credit serves as a crucial lifeline, offering financial support to low-income pensioners and ensuring access to essential care services. However, recent pension credit news has revealed changes that could significantly affect how elderly individuals and their families plan for care.

For example, councils across the UK are urging eligible pensioners to apply for pension credit before applications close on December 21st. Those who are eligible for Pension Credit may also be able to apply for the Winter Fuel Payment as long as they apply before the closing date.

Understanding when to apply is vital, not just for those already in care homes but also for families exploring their options. In this blog, we’ll highlight what pension credit is, how it can help families save money on the cost of care, and the pension credit news and updates impacting the industry.

What is pension credit?

Pension Credit is a government benefit in the UK designed to provide additional financial support for pensioners with limited income. It serves as a top-up to ensure older adults can maintain a basic standard of living during retirement.

The benefit consists of two components: Guarantee Credit, which boosts weekly income to a minimum threshold, and Savings Credit, offering additional support for those who have modest savings or pensions. In April 2024, changes were also made to the amount of money pensioners could claim. The weekly income threshold for single claimants applying for the Guarantee Credit increased to £218.15 from £201.05, while for couples, it rose to £332.95 from £306.85. These adjustments represent an 8.5% increase, aligning with the state pension rise under the triple lock mechanism. Despite its significance, government statistics show that up to £1.7 billion in Pension Credit goes unclaimed annually, with many older adults unaware of their entitlement.

For the Savings portion of Pension Credit, you’ll get up to £17.01 a week if you’re single. If you have a partner, you’ll get up to £19.04 a week.

One key advantage of Pension Credit is its role as a "gateway benefit," unlocking eligibility for other financial aids such as free NHS dental care, housing benefits, Winter Fuel Payment and council tax reductions.

Staying updated with pension credit news is vital as it can make a critical difference in the financial wellbeing for seniors and their families.

The role of pension credit in care home funding

Pension Credit is a critical financial aid for older adults, especially when it comes to managing care home costs. It provides a lifeline for low-income pensioners, ensuring they have the financial support to cover essential expenses while unlocking access to other valuable benefits.

Supporting care home fees

Pension Credit helps reduce the burden of care home fees by topping up the income of eligible individuals.

Interaction with other benefits

Pension Credit can facilitate access to additional financial assistance, significantly enhancing overall support. These include:

- Housing benefit: For those in sheltered or supported housing, Pension Credit can ensure eligibility for Housing Benefit, covering rental costs and freeing up funds for care needs.

- Council tax reduction: Pension Credit recipients typically qualify for council tax discounts or exemptions, lightening the financial load on households.

- Winter Fuel Payment: Only pensioners eligible for Pension Credit can access this payment, which helps manage heating costs during the colder months. For care home residents, this can provide crucial financial relief, ensuring they stay warm and comfortable without added expenses.

By combining these benefits, Pension Credit creates a comprehensive safety net, making it easier for pensioners and their families to manage the costs of care homes and other essentials.

Staying updated on Pension Credit news

With ongoing updates and changes to Pension Credit and associated benefits, staying informed is essential. Understanding recent policy shifts—such as the link between Winter Fuel Payment and Pension Credit eligibility—can ensure that pensioners and their families maximise available financial support.

Pension Credit remains a cornerstone of care home funding strategies, making it a vital consideration for anyone planning for long-term care.

Implications for elderly wellbeing

For elderly individuals entering care homes, financial worries often weigh heavily, impacting both mental health and the choices available to them. Pension Credit is more than just a top-up; it’s a gateway to security, dignity, and improved living standards.

By ensuring that financial barriers don’t limit access to quality care, nutritious meals, or meaningful activities, this benefit creates a foundation for wellbeing. Its impact extends far beyond the numbers, creating peace of mind and enhancing the lives of elderly residents and their families. It also offers a crucial lifeline for elderly individuals and their families, alleviating the stress associated with managing care home fees and everyday expenses.

Challenges and gaps

While Pension Credit has the potential to transform lives, significant hurdles prevent many elderly people from reaping its benefits.

From the widespread lack of awareness of eligibility to the complexities of the application process, barriers persist that leave countless pensioners without the financial support they desperately need. Below, we discuss some of the main challenges and barriers that prevent elderly people claiming pension credit.

Barriers to accessing Pension Credit

Despite its importance, many elderly individuals face challenges in claiming Pension Credit. Barriers include:

- Lack of awareness: Many pensioners remain unaware of their eligibility for Pension Credit, often due to inadequate outreach or misconceptions about qualification criteria.

- Application difficulties: The process of applying for Pension Credit can be daunting, particularly for elderly individuals who may struggle with forms, online platforms, or providing the necessary documentation.

- Eligibility misconceptions: Some pensioners mistakenly believe they do not qualify because they have modest savings or pensions, leading to a significant underutilisation of this benefit.

What families can do

For families navigating care home funding, Pension Credit can provide essential financial support, but knowing how to access it is key. Taking proactive steps can ensure your loved one receives the benefits they’re entitled to, helping to ease the financial strain and secure quality care. Check out our tips below:

Check eligibility

Start by reviewing whether your loved one qualifies for Pension Credit. Many families overlook this benefit, assuming their relative may not be eligible due to small savings or modest pension income. The Pension Credit Calculator on the official GOV.UK website is an excellent tool to determine eligibility.

Apply for Pension Credit

The application process for Pension Credit is straightforward but can be daunting for older individuals. Families can assist by:

- Calling the Pension Credit claim line to apply on behalf of their loved one.

- Preparing necessary documents, such as income details, bank statements, and proof of savings.

- Applying online via the GOV.UK website for convenience.

Encouragingly, claims can be backdated by up to three months, so don’t delay if you suspect your loved one has been missing out.

Seek financial advice

Navigating care home funding options can feel overwhelming, but seeking professional financial advice can make all the difference. Independent advisers can provide guidance on integrating Pension Credit with other benefits like Attendance Allowance, Winter Fuel Payment, and Housing Benefit, maximising available support.

Stay informed of Pension Credit news

Keep up-to-date with Pension Credit news, as policy changes or deadlines may affect eligibility or benefit amounts. Staying informed ensures you won’t miss out on opportunities to secure additional financial support.

By taking these steps, families can ensure their loved ones receive the financial aid they need, creating a more secure and comfortable environment in their care home.

Looking for an affordable care provider?

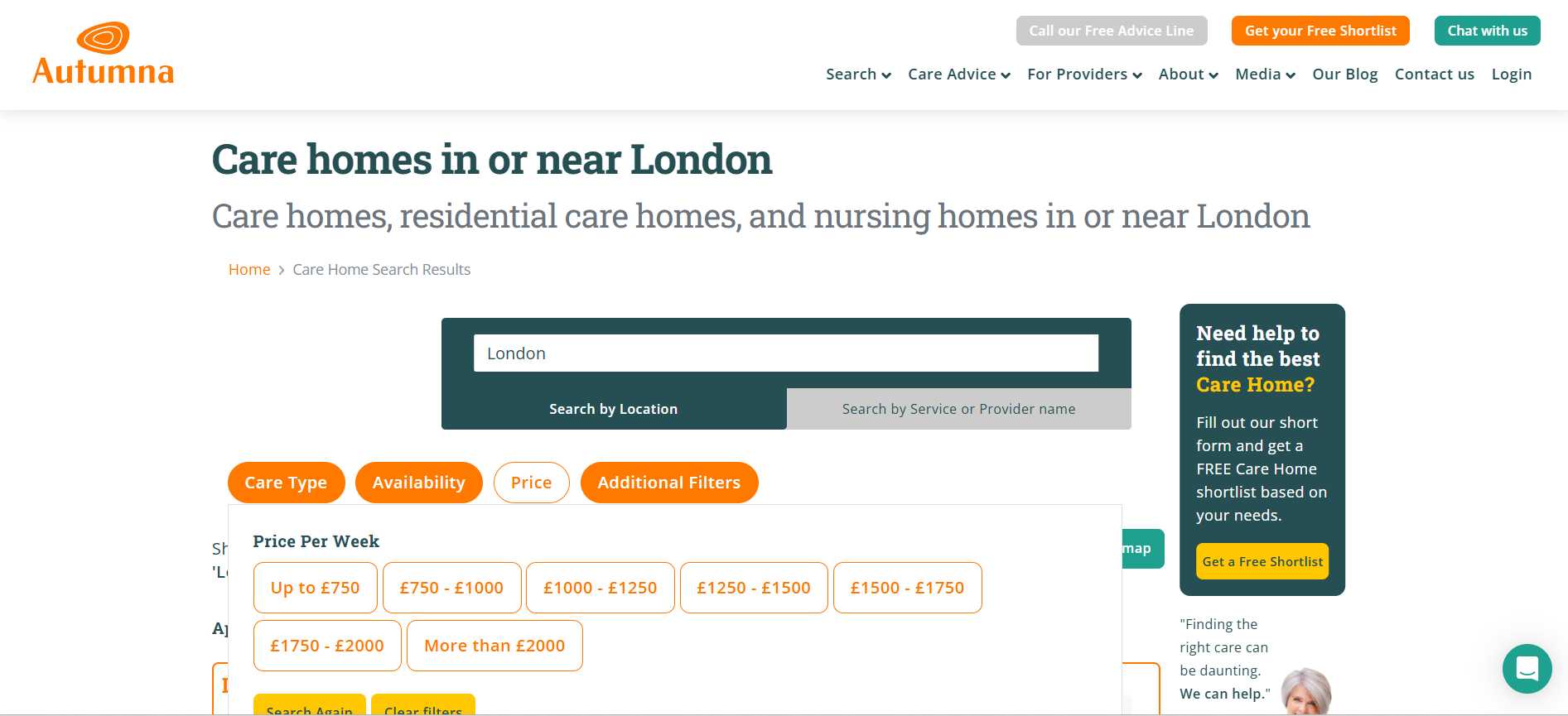

If you are looking for a care provider, Autumna can help. Simply head over to our homepage, and type in your preferred area. You can then view a list of care providers in your location.

Our platform also allows you to filter care facilities by price so you can select your maximum budget when looking at providers.

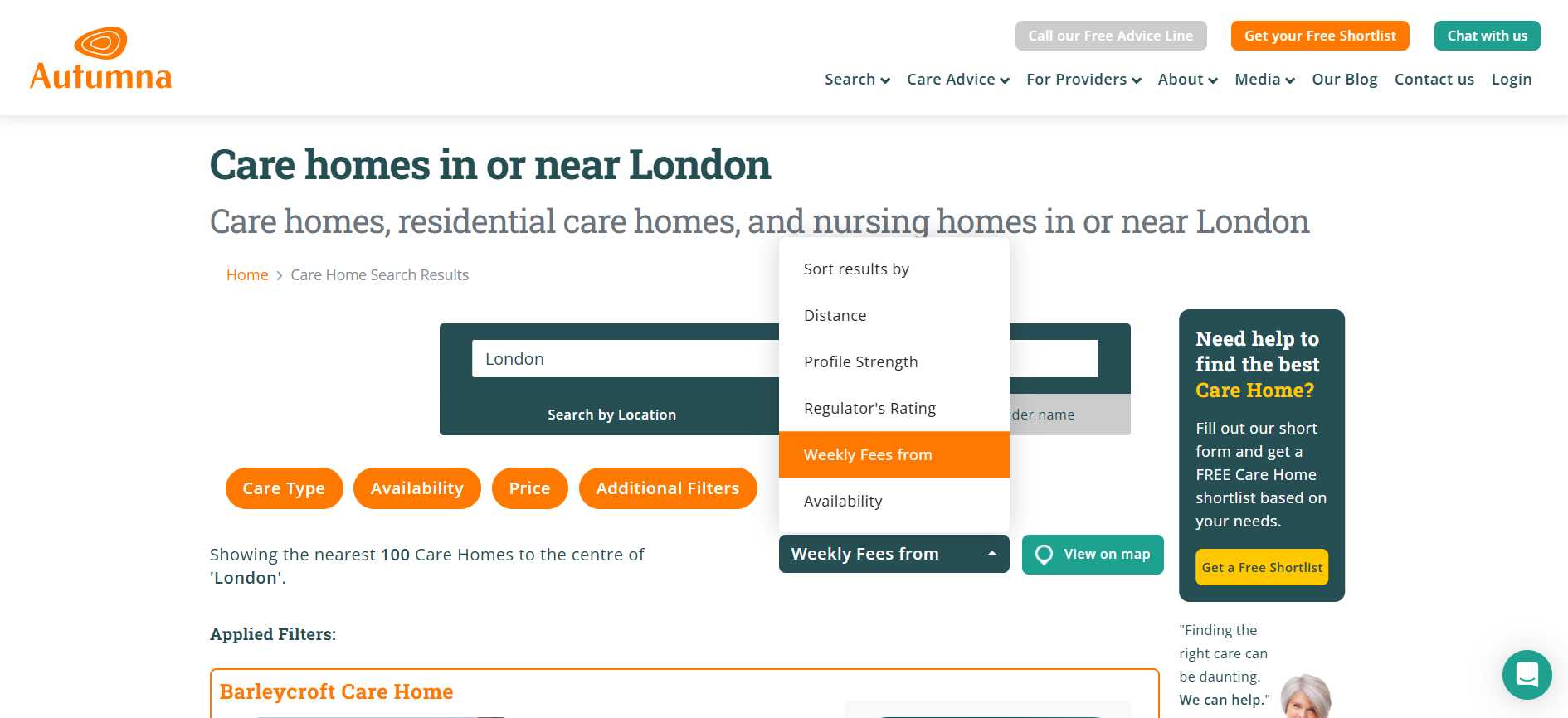

You can also sort providers by weekly fees.

Our shortlisting form can also match you with a more personalised list of providers.

Alternatively, give our advice team a ring on 01892 335 330 for more information.

Receive a Free Care Provider Shortlist!

Let our expert team of advisers get your search off to a great start.

Tell us a little about your needs and we'll send you a bespoke shortlist of care providers! Click the button below to begin, it takes just a few minutes.

Other articles to read

From the blog

Older Persons Care Advice

Ultimate guide to care homes in Norwich

April 23rd, 2025

Discover the best care homes in Norwich—explore lifestyle-focused options, top-rated services, and how to choose the right home with confidence.

Older Persons Care Advice

How to find an adult day care centre near you

April 22nd, 2025

Looking for an adult day care centre near you? Discover how to find safe, joyful care for your loved one—and support for yourself—on Autumna.

Older Persons Care Advice

How to shortlist care homes in Exeter

April 17th, 2025

Need help shortlisting care homes in Exeter? Learn how to filter options with confidence, compare homes, and find the best fit with Autumna’s free tools.

Frequently Asked Questions

Pension Credit is a UK government benefit offering financial support to pensioners with limited income. Eligibility depends on factors such as weekly income and savings.

Pension Credit provides a top-up to minimum income levels, ensuring pensioners can contribute towards care home costs. It also unlocks access to other benefits like Housing Benefit and Attendance Allowance.

Only pensioners eligible for Pension Credit can claim the Winter Fuel Payment, which helps with heating costs during colder months. Apply before deadlines to qualify.

Families can check eligibility using the GOV.UK Pension Credit calculator, assist with applications, and stay updated on Pension Credit news to maximise available benefits.