Posted by Rachel Bashford

Why are investments In UK retirement communities increasing?

The retirement housing market is attracting the attention of big investors.

With a lack of housing stock to home the growing number of over-65s in the UK, we take a look at how investment is changing the face of retirement living.

Keep reading for up-to-date information on:

- The companies investing in retirement living and their future plans

- How these investments are changing the industry landscape

- What’s next for retirement community living

Who is investing in retirement living?

2021 has heralded a raft of investment announcements by big-hitting stakeholders in the property and retirement living world. Legal and General published a statement in August 2021, revealing that they were embarking on a 15-year joint venture with the pension trust fund arm of NatWest to develop a range of UK retirement communities with a £500m deal.

The aim of this project is to produce 5,100 homes for the over-65s on 34 different sites operated by Inspired Villages, part of L&G, who are predicting a value of £4bn for all completed sites on final development.

This fact alone reveals one of the driving forces behind the new investments - companies are aware that they can create housing for a rising portion of our population that are currently not provided for in the market.

According to Inside Housing, the company are preparing to cater for the exponential growth of UK seniors, as L&G estimates there will be an increase from 12m today to around 18m over-65s by 2040.

To house the expanding population of over-65s, property and construction companies are planning to intensify retirement home building over the next few years. Knight Frank has predicted a growth rate of around 9% by 2025. Even with this in place, there is a fear that there will be a shortfall with more over-65s looking for a suitable home than those being constructed.

Another key announcement this year was by the UK Retirement Living Fund. This is managed by Schroders Capital with Octopus Real Estate, who together with Elysian Residences, have launched a joint venture (JV) to acquire an appropriate site in Tunbridge Wells for a £55m development.

Plans are in place to create a purpose-built retirement complex with 89 luxury apartments, matched with hotel-style facilities on site. This type of retirement community is becoming more and more popular in the UK, with a variety of sites currently being developed or planned in a wide range of locations.

It’s true to say that there are a plethora of investment companies extending their presence within the retirement living industry. The Financial Times reports that the asset manager, BlackRock, has agreed to a £100m joint venture with Audley Group, a retirement living development firm. This partnership plans to create 1,000 homes, with the first being a 255-home development in Watford.

Why are more companies investing in retirement living?

The big question is why are firms turning to retirement living for their future investments? What is it about this sector that is appealing? Well, it appears that they have noticed the large gap between the growing number of seniors and the availability of decent, desirable housing that people want to live in.

The Centre For Ageing Better has produced a short video revealing some worries and concerns older people have when faced with living by themselves or dealing with home repairs.

Having to struggle alone to find people to help repair poor housing or just to have a bit of company are key reasons behind over-65s looking for more sociable housing opportunities with the kind of leisure facilities that will improve their quality of life.

It would be fair to say that UK investment and property companies are beginning to take the opportunities that are becoming available to prepare for future senior housing need. Planning permission is being granted more often for retirement living developments as there is a recognition that the supply is not currently in existence in many areas.

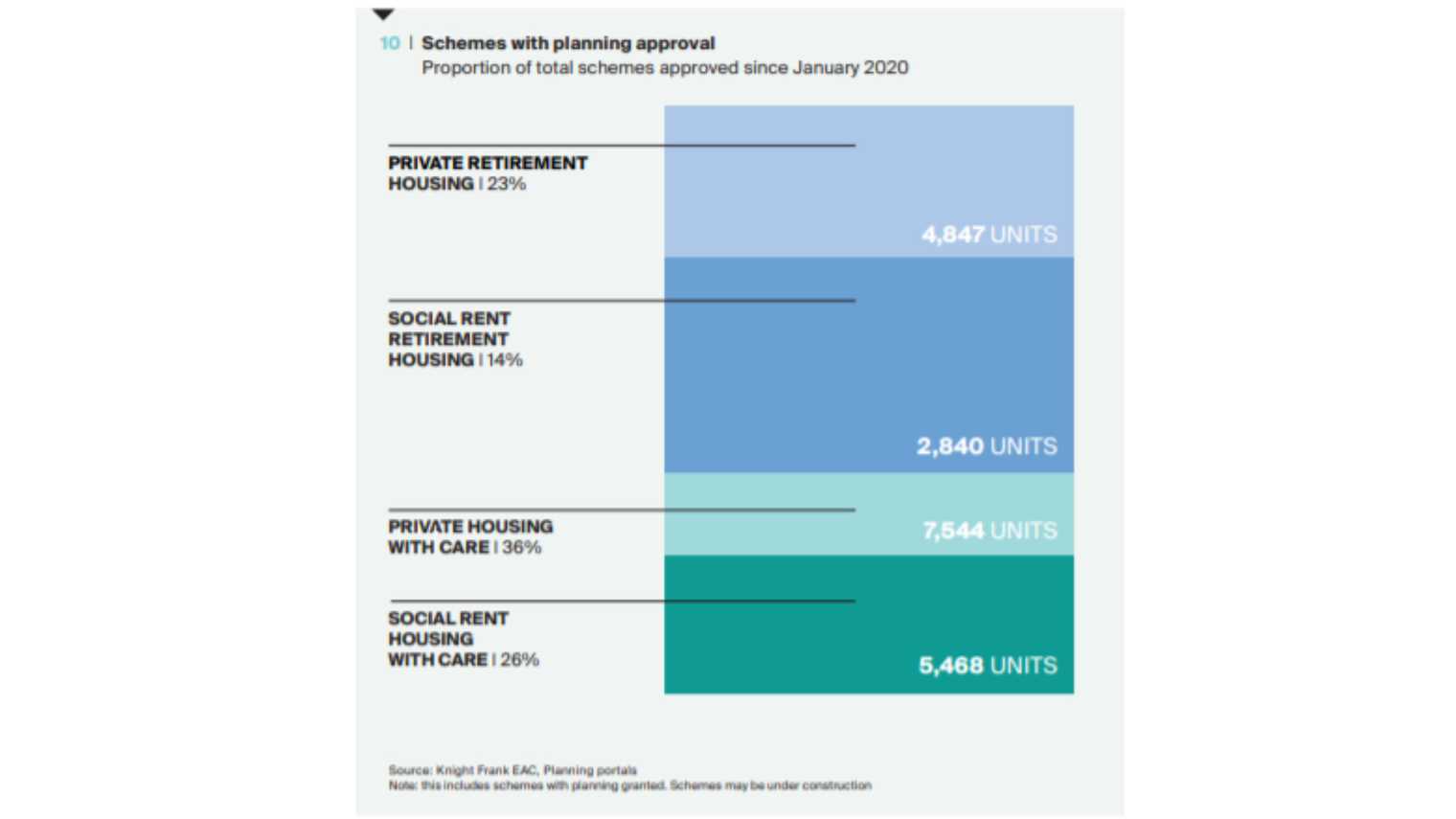

Reporting about the state of the senior housing sector in 2021, Knight Frank revealed that future scheme approval is showing a rise in the amount of private retirement housing being agreed at 23% and private housing with care at 36% of the total.

It appears that planners and construction firms are reacting to seniors and their desire for better homes with enjoyable, attractive facilities. Certainly, more and more older people are looking to continue their hobbies and interests, while gaining the safety and security that retirement communities provide.

How are investments changing the future of retirement living?

There is no doubt that the Covid pandemic has altered the way both older people and construction companies view potential housing opportunities. Many older people have suffered a great deal of isolation and severe restriction as a result of lockdowns and other containments on ordinary life.

As a result, people are beginning to look ahead and plan for their retirement or for the next life stage. Many feel that all the things that they want to enjoy – leisure, hobbies, social activities, company at home – are missing from life right now. Combining attractive homes with safety, leisure facilities and support if needed is a realistic and achievable option.

With all the investments being secured within the sector, what is changing? Property Week has defined some future trends it sees developing in the market as a result of Covid and with the security of future funding:

- Larger communities with flexible access to services and senior housing.

- Independent living with greater availability of medical services.

- Urban sites with proximity to metropolitan entertainment and culture.

- Development of mixed-use schemes – those with retirement living apartments, guest accommodation and retail amenities.

Urban living is becoming a popular choice, both for developers and for seniors looking to enjoy their retirement years. Plenty of urban dwellers, who have lived in towns and cities all their lives, want to stay in the place they call home.

Paired with the opening up of vacant locations in town and city centres due to the pandemic, there has been an upsurge in older people searching for this type of retirement home.

The Guardian reported this upward trend, detailing how retirement communities are branching out into city apartment blocks to accommodate lifestyle choices. These new residences are purposely designed to maximise the city lifestyle as well as having access to the health, medical and security benefits you would expect from retirement living.

So, are property developers making the most of available space in towns and cities near your home? Many have been planning, preparing and building for some time to enhance retirement living for over-65s in metropolitan areas all over the UK.

One Housing has developed an urban retirement community in the heart of South London, enabling seniors to live locally, enjoy the life they are accustomed to and be near family and friends. Companies such as Birchgrove have added centrally-located retirement apartments to their portfolio, such as Queensgate Apartments in Sidcup, Kent.

If you’re looking for retirement living opportunities or want to research future options, then Autumna’s search bar has one of the most extensive directories of all types of retirement living available. It’s easy to use and includes lots of essential information about each retirement property.

What Is The Future Of Retirement Living In The UK?

The prediction is that retirement communities supplying housing with access to healthcare and support for emerging care needs could be a real solution to the potential housing issues looming for older people.

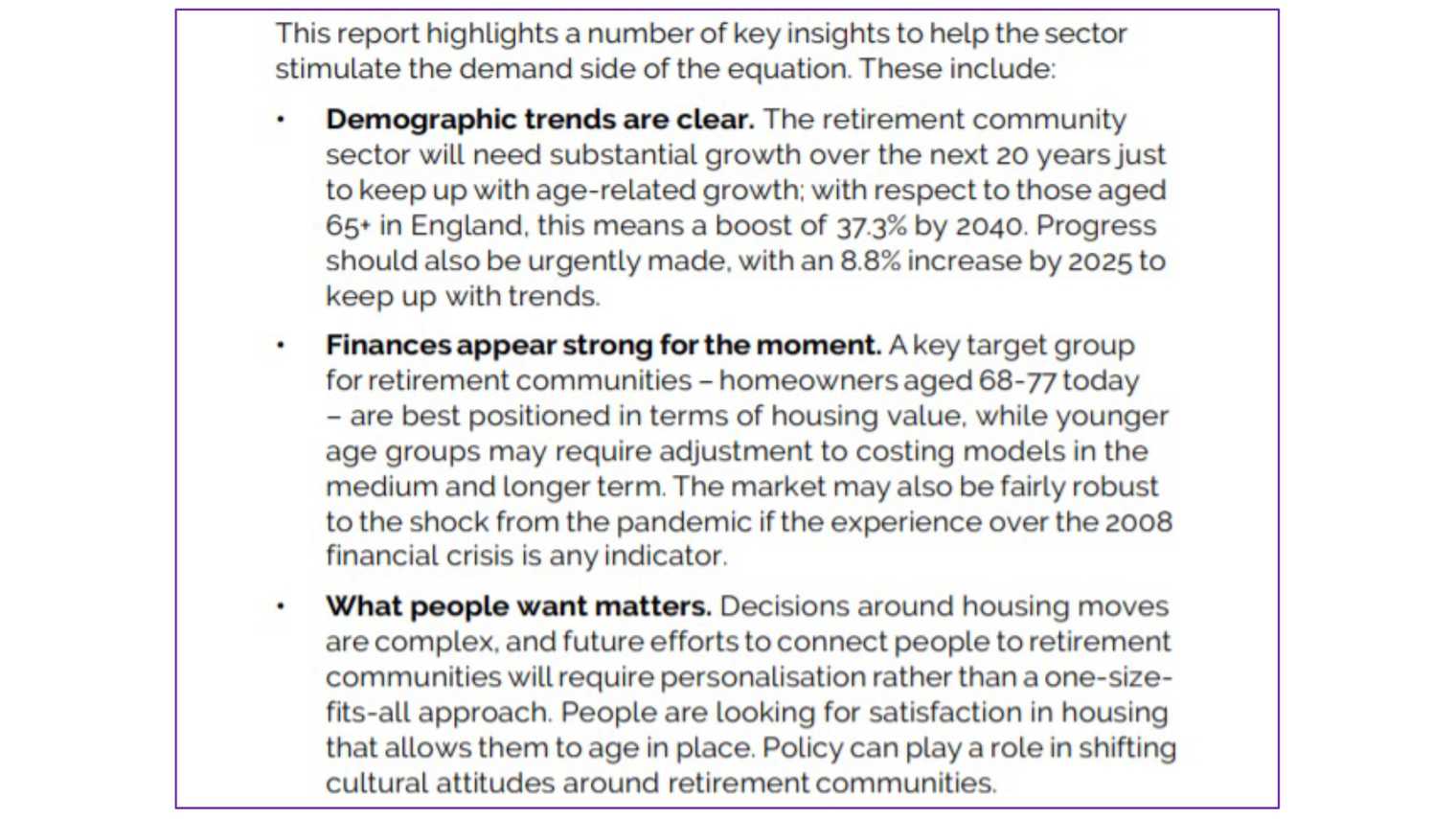

A recent report from the International Longevity Centre UK highlights the concerns which are preoccupying both seniors and the retirement living sector as a whole. Financially, people in this age group could have the capital to be able to make the best choices for their individual circumstances, which means they are able to choose a secure place to live while enjoying a varied lifestyle.

In addition, the report also implies that personalised approaches to housing are becoming ever more important, as people are searching for housing that enables them to age in place.

The ILC’s final report found that the following key identifiers will shape the future of retirement living developments:

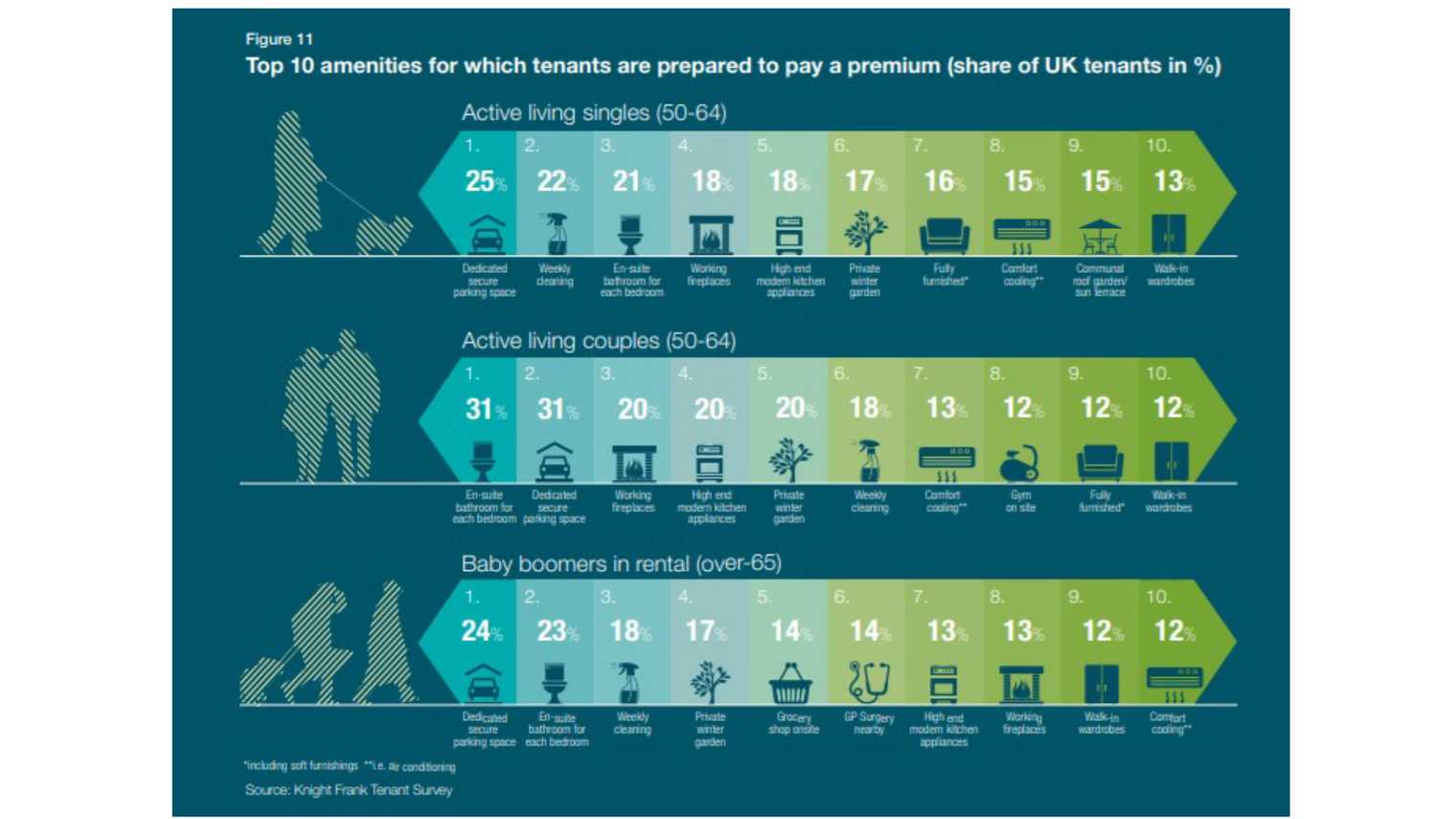

It’s also interesting to note that the over-65s are becoming clear about what requirements are necessary in their housing. Knight Frank surveyed a range of older people to discover their top 10 home amenities:

How can I find the best retirement village near me?

Growing numbers of people are turning to Autumna to get help when looking for a retirement community. Why not browse the website or alternatively let us narrow your search by completing this simple questionnaire?

Autumna has gathered detailed information from a wide variety of sources, and consolidated it into a rich information resource that will help you, quickly and easily, find exactly what you need, when you need it.

If you’re still not sure what you need, this quick video presentation by Autumna’s founder, Debbie Harris will give you some useful pointers.

And don't forget our advice line on 01892 335 330 is open seven days a week (8:30am - 5:30pm Mon-Fri, 10am - 5pm Sat, 10am - 4pm Sun).

Other articles to read

Autumna Blog

Retirement Living

Renting a Retirement Living Flat in the UK: A Step-by-Step Guide

May 13th, 2024

When you want to enjoy the lifestyle that a retirement village offers but don’t want to commit to buying a property, then this step-by-step guide to renting a retirement flat could help you.

Retirement Living

The benefits of exercise in old age

April 27th, 2024

Increasing numbers of older people are choosing to live in retirement villages that promote exercise and well-being. How does exercise affect older adults?

Retirement Living

Can a Pensioner Get a Mortgage to Buy a Retirement Property?

March 12th, 2024

Considering buying a retirement living home? This guide explains how to apply for a mortgage and where to compare retirement living properties near you.